Understanding Digital Arrest Scams: What Americans and Brits Need to Know Right Now

You pick up the phone, and someone claiming to be from the IRS or HMRC tells you there’s a warrant for your arrest. Your heart races. They sound official, they have badge numbers, and they’re demanding immediate payment. Hang up. It’s a scam.

Digital arrest schemes have quietly become one of the most profitable fraud operations targeting people in the United States and United Kingdom. While the term “digital arrest” started in India, the core tactics fake authority figures, time pressure, and fear-based money extraction have spread globally with devastating results.

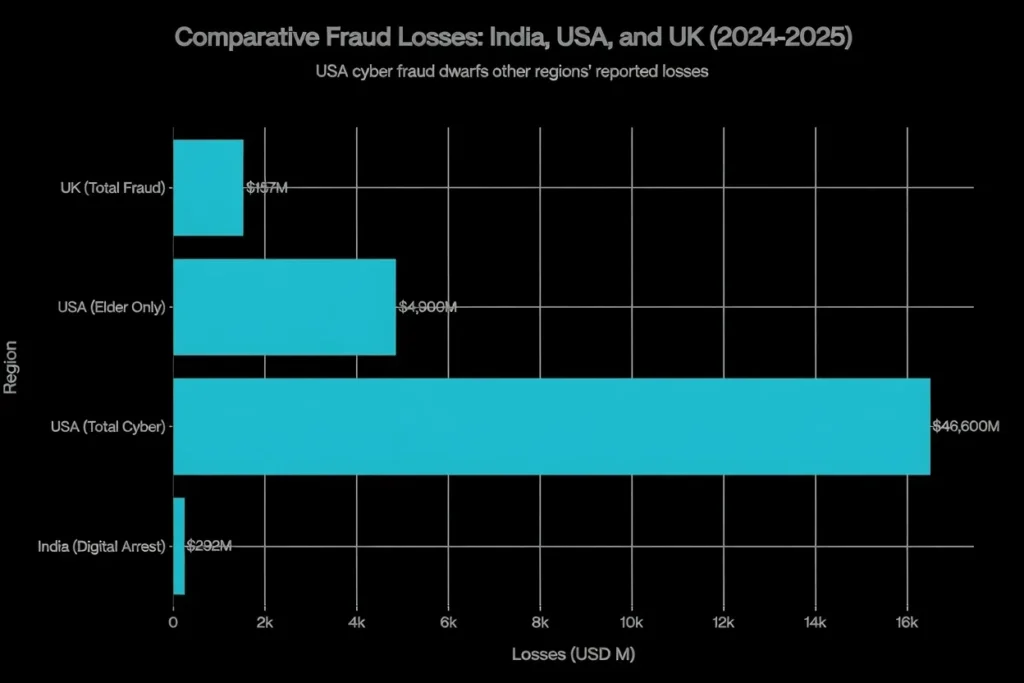

The numbers tell a chilling story. Americans lost $16.6 billion to cyber fraud in 2024, a 33% jump from the previous year. Older adults alone lost $4.9 billion. Across the pond, the UK reported over 2 million fraud cases in just the first half of 2025, with criminals stealing £629 million.

But here’s what makes these scams particularly dangerous: they don’t rely on technical hacking. They hack your psychology instead.

Table of Contents

What Exactly Is a Digital Arrest Scam?

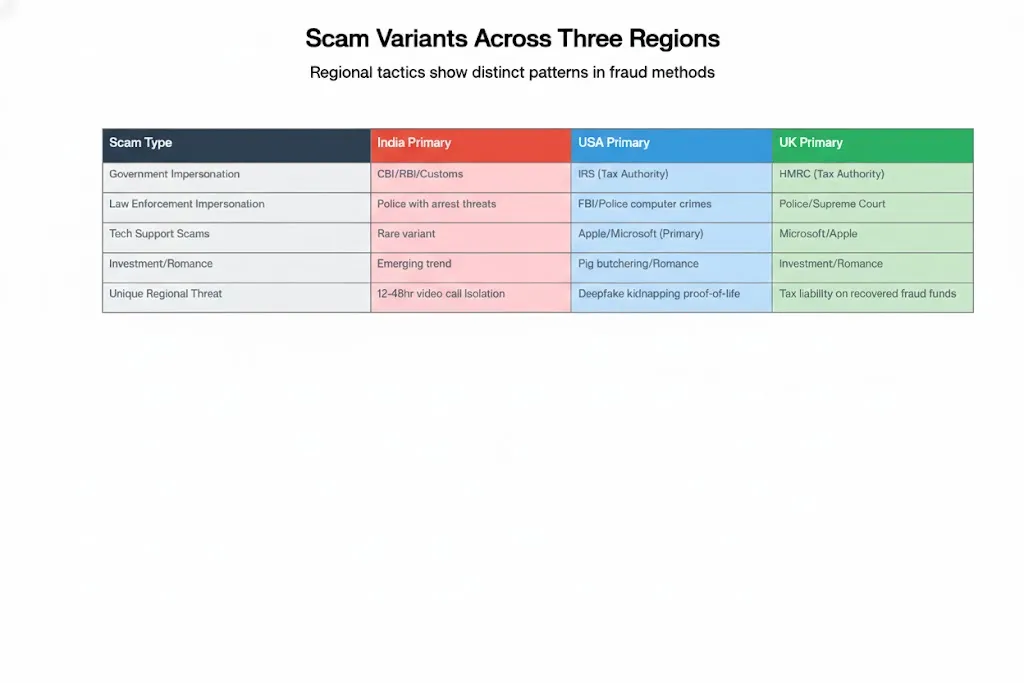

Think of it as psychological kidnapping. Scammers impersonate government officials—IRS agents in the US, HMRC officers in the UK, sometimes police or court officials. They create a fake crisis that demands your immediate attention and payment.

The playbook is surprisingly consistent. They’ll claim you owe back taxes, you’re under investigation for fraud, or worse—there’s an active warrant for your arrest. The timeline is always urgent: “You have two hours before we send officers to your home.” The payment method is always sketchy: gift cards, wire transfers, cryptocurrency.

In the US, IRS impersonation has cost Americans nearly $3 billion. In the UK, HMRC scams have become so sophisticated that even tech-savvy professionals struggle to spot them.

How Digital Arrest Scams Work in America

The IRS Impersonation Playbook

The American version typically starts with a robocall. Your caller ID might even display “IRS” or an official-sounding department name. Someone with a professional tone tells you about a tax discrepancy from three years ago. Maybe you owe $45,000. Maybe your refund has been seized. Maybe they’re filing a lawsuit.

Here’s the pressure point: “You have two hours to resolve this before we issue an arrest warrant.”

The IRS received over 1 million complaints about threatening calls like these. The scam works because Americans carry genuine anxiety about taxes. Our tax code is complex, audits are expensive ($2,000-$10,000 just to hire a CPA), and people worry they might have made a mistake on their returns.

Scammers exploit that worry. They provide fake badge numbers and claim numbers that sound legitimate. They instruct you to pay immediately using iTunes cards, Google Play cards, or wire transfers—payment methods that are impossible to reverse or trace.

The 2025 IRS “Dirty Dozen” scam list now includes AI-powered voicemails that sound flawlessly professional, making it nearly impossible to identify fraud by voice alone.

Virtual Kidnapping: The AI-Powered Nightmare

This newer variant is particularly terrifying for parents and grandparents. Instead of claiming you owe money, scammers claim they’ve kidnapped your loved one.

In January 2024, 17-year-old exchange student Zhuang was manipulated by scammers for weeks. They eventually convinced him to isolate himself in the Utah wilderness while they sent fabricated “proof of life” photos to his parents in China. His family paid $80,000 before discovering their son was never actually kidnapped.

Now scammers are using AI deepfakes to create fake videos and audio of loved ones in distress. They steal photos from social media, use AI to generate voices, and send text messages with ransom demands between $10,000 and $100,000.

The FBI reports that these schemes are exponentially more effective than traditional scams because they hijack parental instinct. When you see what looks like your child crying for help, rational thinking shuts down.

Tech Support Scams: Preying on Technology Fears

Older Americans face another dangerous variant: fake tech support calls. Someone claiming to be from Microsoft, Apple, or Norton calls saying they’ve detected malicious software on your device.

They request remote access through programs like TeamViewer or AnyDesk. Once you grant permission, they create fake error messages using Windows system tools, claim your computer is compromised, and demand payment ranging from $200 to $2,000.

Americans over 60 are six times more likely than younger people to lose money to tech support scams. The Federal Trade Commission reports these scams cost older adults $159 million in 2024 alone.

Why Americans Fall for These Scams

Tax anxiety is deeply embedded in American culture. The IRS carries enormous legal power, and people know that ignoring real tax problems leads to serious consequences. When someone calls claiming to be from the IRS, many Americans assume it might be legitimate simply because they’re not sure.

Here’s the critical thing most people don’t know: The IRS does not initiate contact demanding payment, threatening arrest, or requesting personal information by phone, email, or text. Initial contact is made by formal postal mail.

Technology fear compounds the problem, especially for older adults. After decades of hearing about data breaches and identity theft, the idea that your computer might be compromised feels plausible. When someone calls claiming to be from Microsoft with a solution, relief overrides skepticism.

Finally, there’s the generational trust factor. People who grew up in an era when institutions were generally trustworthy carry that baseline assumption into modern interactions. Scammers weaponize that trust.

Who’s Most Vulnerable in the US?

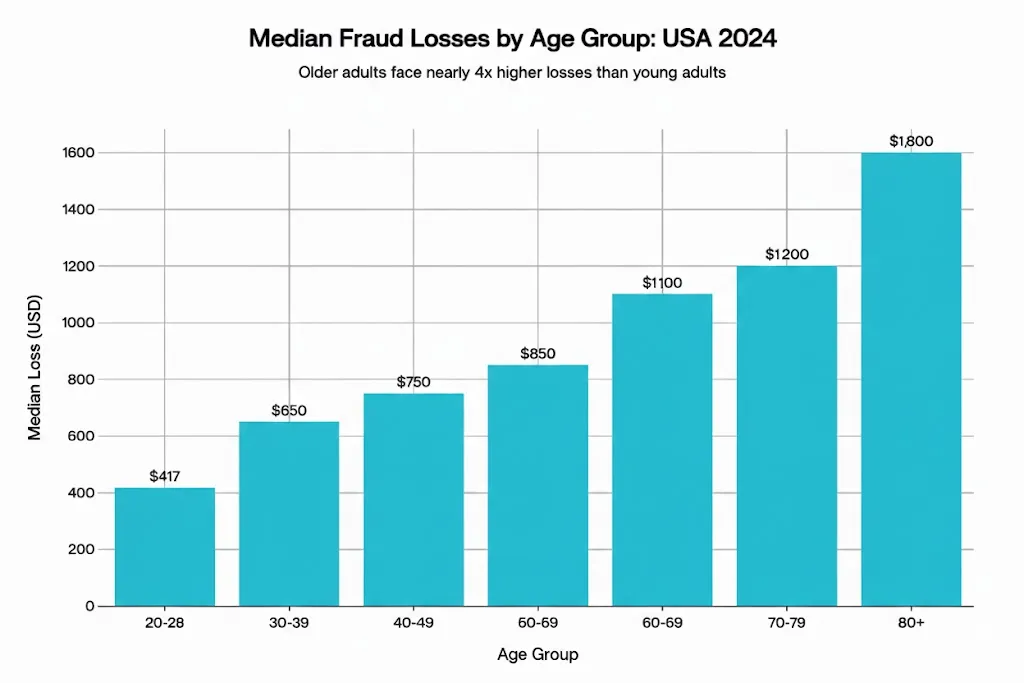

The data reveals a troubling pattern. While younger Americans report more fraud incidents, older Americans lose significantly more money per incident.

In 2024, people in their 60s collectively reported $1.18 billion in fraud losses—nearly the same aggregate amount as people in their 30s, despite similar complaint volumes. This reveals that seniors face higher-value fraud and experience compounding vulnerability: fixed incomes, reluctance or inability to work longer, and limited time for financial recovery.

The age-poverty nexus becomes particularly dangerous when you realize that older adults often hold larger liquid assets—retirement accounts, savings bonds, home equity—making them attractive targets for scammers seeking big payouts.

How Digital Arrest Scams Work in the United Kingdom

HMRC Impersonation: The British Tax Trap

The UK faces its own version centered on HMRC fraud. Between January 2024 and January 2025, HMRC reported 135,500 scam incidents. Since February 2025 alone, they’ve documented 4,800 self-assessment scams and 29,000 fraudulent tax refund claims.

The mechanics mirror American IRS scams but with British flavors. Common variants include:

Fake Refund Offers: “You’re eligible for a £1,200 tax refund. Provide your bank details to claim it.” Victims hand over complete account access, and scammers drain their accounts.

Fraudulent Tax Demands: “A criminal case is registered in your name for tax evasion. Transfer £8,500 immediately, or we’ll issue an arrest warrant.” These come via email or text with official-looking HMRC letterheads.

Investigation Threats: “We’ve detected suspicious activity on your account. To verify your identity, provide your National Insurance number and account password.”

The sophistication escalated dramatically in 2025. AI-generated emails now mimic HMRC’s digital communications so precisely that even tech-literate professionals struggle to distinguish them from legitimate correspondence.

The UK’s Unique Nightmare: Tax on Recovered Fraud Money

Here’s where the UK situation becomes particularly cruel. When fraud victims recover stolen pension funds or investment losses, HMRC treats these recoveries as “unauthorized payments” subject to penalty taxes of 55-70%.

Let me break down how devastating this becomes:

A victim loses £500,000 in pension savings to investment fraud. After police investigation and recovery efforts, they get £250,000 back. Then HMRC issues a tax bill: 55% of £250,000 equals £137,500 in tax liability on money the victim never actually had and no longer has.

This creates layered trauma: first the crime and financial devastation, then the hope of recovery, then an unexpected tax penalty that can render victims homeless or destitute.

Baroness Newlove, the UK’s Victims’ Commissioner, publicly condemned HMRC’s treatment of fraud victims, noting: “Some victims have detected from HMRC a culture of victim blaming, making them feel as if they have been labelled as tax avoiders… I have been told about victims who have felt suicidal due to their treatment by HMRC. Some victims have found this treatment to be as traumatising as the crime itself.”

Shockingly, HMRC isn’t listed under the Victims Code, meaning fraud victims have no formal victim protection status when dealing with the tax authority—unlike their protections when interacting with police or prosecution services.

Police and Supreme Court Impersonation

British scammers also pose as police officers claiming to investigate “cloned bank cards.” Victims are asked to transfer money to “police accounts” to verify their identity. In one documented Devon case, an 80-year-old victim transferred over £25,000 before discovering the fraud.

Starting in 2025, scammers began impersonating the UK Supreme Court, claiming victims are involved in legal cases and demanding payment. They clone legitimate court phone numbers and use official logos and names of actual court employees. This variant exploits the authority of the judiciary itself and creates confusion because recipients legitimately might need to interact with courts.

Why British Citizens Are Vulnerable

British citizens maintain high baseline trust in institutions like HMRC and the judiciary. These organizations are genuinely powerful and relatively independent from political control. When someone claiming to be from HMRC calls with technical jargon about “tax liability adjustments” and “provisional assessments,” compliance feels rational rather than fearful.

The UK’s self-assessment tax system creates predictable periods of high anxiety, particularly around the January 31 deadline. Scammers time their campaigns strategically, knowing millions will be receiving legitimate HMRC correspondence. The psychological overlap—”Did I actually fill out my self-assessment correctly?”—creates doubt that makes people skip verification steps.

Unlike Americans who’ve experienced IRS scams for over a decade and developed cultural skepticism (“The real IRS never calls”), British citizens experiencing HMRC scams are often first-time victims of this specific crime. The cultural narrative of HMRC impersonation fraud doesn’t yet exist at the same level.

Finally, there’s the tax liability trap. Unlike the US where recovering fraud simply returns funds to the victim, the UK’s tax system creates incentive for criminals to target high-net-worth individuals with complex tax situations. A CEO with £2 million in investments is worth targeting because even if they recover 50% of losses, they face a massive tax bill on the recovered portion—essentially a “recovery penalty.”

The Scale of the Problem: US vs UK

When you look at raw numbers, US cyber fraud reached $16.6 billion in 2024, dwarfing both India’s digital arrest scams ($232 million) and UK’s total fraud (£1.26 billion annualized). But this reflects both the larger population and the broader definition of cyber fraud in the US, which includes business email compromise, ransomware, and data breaches—not just impersonation.

When comparing government impersonation scams specifically:

- India Digital Arrest: approximately $232 million

- US IRS Impersonation: approximately $3 billion

- UK HMRC Impersonation: approximately $80-100 million

The US government impersonation threat actually exceeds India’s digital arrest threat in absolute dollars and per-capita rates.

For more information on how scammers are using voice cloning technology in these schemes, check out this comprehensive guide on protecting yourself from voice cloning scams.

Red Flags That Scream “SCAM” – For Americans

Understanding what legitimate government agencies will never do is your first line of defense. These red flags are 100% diagnostic—if you see them, you’re dealing with a scam.

IRS and Government Impersonation Red Flags

Initial Contact Method: The IRS will never, under any circumstances, initiate contact via phone, email, or text message. They communicate through formal postal mail, period. If someone calls claiming to be from the IRS about a tax issue you weren’t already aware of, it’s a scam.

Payment Methods: No legitimate government agency will ever ask for payment via iTunes cards, Google Play cards, Amazon gift cards, cryptocurrency, or wire transfer. The IRS accepts checks, money orders, or electronic payments through official IRS.gov payment portals—never through third-party services.

Immediate Action Demands: Real IRS issues unfold over months with multiple written notices. If someone claims you have two hours to pay before facing arrest, hang up immediately.

Threats of Arrest: The IRS doesn’t arrest people for tax debt. Local police don’t enforce federal tax law. If someone threatens immediate arrest for tax issues, it’s fake.

Request for Personal Information: The IRS already has your Social Security number, address, and financial information. They’ll never call asking you to confirm these details.

Caller ID Spoofing: Even if your caller ID displays “IRS” or an official-sounding number, scammers can fake this. Never trust caller ID alone.

Virtual Kidnapping Red Flags

Immediate Ransom Demand: Real kidnappers typically establish proof of life before demanding ransom. Scammers demand payment immediately, often within hours.

Refusal to Let You Call Back: They’ll insist you stay on the line and threaten harm if you hang up. This prevents you from verifying the situation independently.

Background Noise Inconsistencies: Listen carefully. AI-generated audio or videos often have unnatural background sounds or voices that don’t quite match lip movements.

Demanding Unusual Payment: Legitimate kidnappers might demand cash drops or bank transfers. Virtual kidnappers often request gift cards or cryptocurrency—methods that make them harder to trace.

You Can’t Reach Your Loved One: Before panicking, try calling or texting your family member at their known number. Often, they’re simply in class, at work, or their phone is on silent.

Tech Support Scam Red Flags

Unsolicited Contact: Microsoft, Apple, and Norton do not make outbound calls to warn about computer problems. If they call you out of nowhere, it’s a scam.

Remote Access Request: Legitimate tech support from major companies doesn’t require remote access unless you initiated the contact through official channels.

Payment for “Protection”: Real antivirus companies charge through subscriptions you set up yourself, not sudden payment demands during calls.

Pressure and Fear: Legitimate tech support explains issues calmly. Scammers use urgent language: “Your computer will crash in 24 hours,” “Hackers are stealing your data right now.”

Red Flags That Scream “SCAM” – For Brits

HMRC Impersonation Red Flags

Contact Method: HMRC will never ask for personal or financial details via phone, email, or text message. Legitimate HMRC communication comes through your registered online account or by letter.

Payment Demands via Text/Email: If you receive a text or email demanding immediate tax payment, it’s fake. HMRC doesn’t collect taxes this way.

Refund Offers Requiring Bank Details: HMRC doesn’t offer refunds via email or text links. Refunds are processed through your tax return or sent by check.

Threats of Immediate Legal Action: Real tax investigations take months with formal written notices. Claims that you’ll be arrested within hours are false.

Links to External Websites: Legitimate HMRC communications never include clickable links to external payment sites. Always navigate to GOV.UK directly.

Suspicious Sender Addresses: Check email addresses carefully. Legitimate HMRC emails come from gov.uk domains, not Gmail, Outlook, or similar services.

Police Impersonation Red Flags

Requests to Transfer Money: Real police never ask you to transfer money to “verify your identity” or for “safekeeping” during investigations.

Immediate Action Without Documentation: Legitimate police provide written documentation for investigations. Phone-only requests are suspicious.

Pressure to Act Quickly: Real police investigations move methodically. Scammers create artificial urgency: “Transfer the money in the next hour or lose everything.”

Supreme Court Impersonation Red Flags

Initial Phone Contact: The UK Supreme Court communicates through formal written notices, not unsolicited phone calls.

Demands for Immediate Payment: Court-related fees are paid through official court channels with proper documentation, never via phone payment demands.

Unable to Verify Independently: If you can’t find the case number or court reference through independent searches of official court records, it’s fake.

Protection Strategies for Americans

Let me walk you through practical steps you can take right now to protect yourself and your family.

Immediate Actions You Can Take Today

Create a Verification Call List: Print out a physical list and stick it on your refrigerator. Include:

- Your bank’s fraud line (from the back of your debit card, not from memory)

- FBI IC3: ic3.gov or 1-855-292-3937

- FTC: reportfraud.ftc.gov or 1-877-438-4338

- IRS: 1-800-829-1040 (official line only)

- Your accountant or tax professional’s direct number

- Your adult children’s phone numbers

Having this physically written eliminates the risk of calling a scammer’s number they provided during the call.

Enable Fraud Alerts: Call your bank today and request fraud alerts on all accounts. Set up transaction notifications for any transaction over $100. Most banks offer this free service but require you to opt in.

Set Up Multi-Factor Authentication: Enable two-factor authentication on your email and banking apps immediately. This adds a critical layer of protection even if scammers get your password.

Request Caller ID Verification: Ask your phone service provider about caller ID verification features. Some carriers offer enhanced verification that flags potential spam or spoofed calls.

For Seniors: Additional Protection Steps

If you’re over 60 or helping an older family member, these additional steps are crucial:

Establish a Family Verification Protocol: Agree with your adult children or trusted family members that you’ll never make major financial decisions without consulting them first. If anyone calls claiming urgent legal or financial crisis, your first call should be to your designated family contact.

Use a Scam Response Script: Write this down and keep it by your phone:

“I need to verify this independently. Please provide your name, badge number, and department. I will call back using the official number from the government website.”

Then hang up. Wait five minutes to ensure you hear a dial tone. Call the official number from your verification list—never use a number the caller provided.

Consider a Call Screening Service: Services like RoboKiller or Nomorobo can filter many spam and scam calls before they reach you. Your phone carrier may also offer call screening features.

What to Do When You Receive a Suspicious Call

Within the First 5 Minutes:

Hang up without explanation. You don’t need to tell them why you’re disconnecting. Don’t offer any verification information, not even to “prove” they’re wrong about you owing money.

Turn off your phone for two minutes. This ensures you get a fresh dial tone and prevents clever scammers from staying on the line even after you hang up.

Call the FBI IC3 at 1-855-292-3937 or visit ic3.gov to report the incident. Provide the phone number they called from, any names or reference numbers they used, and what they claimed.

If You Suspect Virtual Kidnapping:

Immediately call your loved one at their known phone number. Do not use any number provided by the person claiming to have kidnapped them.

If you can’t reach your loved one through their known contact information, call local police. Dial 911 if you believe there’s an emergency.

Report to FBI IC3 immediately at ic3.gov. The FBI can coordinate with local law enforcement if necessary.

Never send money before confirming your loved one is actually missing. Most virtual kidnapping attempts target people who are simply unavailable at that moment—in class, at work, or in a movie theater.

If You Already Transferred Money:

Call your bank immediately—within one hour if possible. Ask them to place a “fraud hold” on the transaction. Time is critical here because banks typically have 24-48 hours to freeze transfers before they’re completed.

Provide your bank with any complaint numbers you receive from filing reports with the FTC or FBI. This documentation helps them take your case seriously.

Request they contact the beneficiary bank to freeze the receiving account. Many banks will do this for confirmed fraud cases.

File an FBI IC3 complaint within 24 hours at ic3.gov. The FBI’s Recovery Asset Team has a 66% success rate in freezing fraudulent transfers when contacted quickly.

Recovery Steps After an Attack

Step 1: Official Reporting (First 48 Hours)

File reports with multiple agencies. Each serves a different purpose:

- FBI IC3 (ic3.gov): Provides a complaint number and shares information with law enforcement nationwide

- FTC (reportfraud.ftc.gov): Creates a Consumer Sentinel record that helps track fraud patterns

- IRS (if IRS impersonation): IRS.gov/identity-theft or 1-800-908-4490

- Local Police: File a local report to get a reference number for insurance claims

- Your Bank: Provide all complaint numbers and evidence to their fraud department

Step 2: Financial Institution Intervention

Banks typically have 24-48 hours to freeze transfers to beneficiary accounts. The FBI’s Recovery Asset Team can request emergency account freezes, dramatically improving recovery odds.

Cryptocurrency exchanges increasingly cooperate with law enforcement to reverse transfers, with recovery rates of 36-66% through coordinated action—though success depends on how quickly you act.

Step 3: Credit Monitoring

Place a seven-year fraud alert with all three credit bureaus: Equifax, Experian, and TransUnion. Consider a complete credit freeze if you’re particularly concerned.

Monitor your credit reports monthly through annualcreditreport.com, which provides free reports once per year from each bureau.

Step 4: Tax Impact Considerations

Keep comprehensive documentation showing you were scammed. If you paid money to scammers claiming it was taxes owed, this is not tax deductible.

Report the incident to the IRS Identity Theft department at IRS.gov/identity-theft to protect your actual tax record from future complications.

Protection Strategies for British Citizens

Immediate Actions You Can Take Today

Create Your Verification Call List: Print this out and keep it visible:

- Your bank’s fraud line (from the back of your bank card)

- Action Fraud: 0300 123 2040

- Local police non-emergency: 101

- HMRC Scam Report line (search “report HMRC scam” on GOV.UK)

- Your accountant’s direct number

- Your adult children’s phone numbers

Register for Your HMRC Online Account: Visit gov.uk and register for your personal tax account through the GOV.UK Verify system. All legitimate HMRC communications will appear in this account or arrive by formal letter. This single step prevents most HMRC impersonation scams because you can verify any claim independently.

Enable Banking Protections: Request fraud alerts on all accounts. Enable SMS alerts for transactions over £500. Ask your bank about “Confirmation of Payee” (CoP)—a system that flags unusual transfers and verifies recipient account details match the name you think you’re sending to.

Set Up Two-Factor Authentication: Enable multi-factor authentication on all online banking and email accounts. This critical step prevents scammers from accessing accounts even if they steal your passwords.

For Seniors: Additional Safety Measures

Keep Tax Documents Organized: Maintain six years of tax records. HMRC has records of all filed returns. If someone claims you owe back taxes, you can independently verify by checking your organized records.

Never Click Email Links: Train yourself to never click links in emails claiming to be from HMRC. Always navigate to GOV.UK directly by typing the address into your browser.

Create a Family Verification Protocol: Establish with adult children or trusted family members that you’ll never make major financial decisions without consultation, especially if someone is pressuring you for immediate action.

What to Do When You Receive a Suspicious Contact

If You Receive an HMRC Scam Call or Email:

Hang up or delete the email immediately. Don’t click any links. Don’t provide any information.

Call HMRC directly on 0300 200 3300—a number you obtain from gov.uk, not from the email or caller.

Report to Action Fraud at 0300 123 2040 or actionfraud.police.uk.

Report to your bank’s fraud team as a precaution, especially if you provided any information.

If You’ve Already Transferred Money:

Contact your bank within one hour if possible. Time is absolutely critical.

Ask about the Confirmation of Payee service to flag the recipient account. Banks use this to verify whether the account name matches what you were told.

Request an emergency freeze of transferred funds. UK banks typically have two to three days to freeze transfers before they’re fully processed.

File an Action Fraud report within 24 hours. This creates an official police record and starts the investigation process.

File a local police report by calling 101 within 48 hours. This provides additional documentation for recovery efforts.

Recovery Steps After an Attack

Step 1: Reporting (First 48 Hours)

File with multiple agencies:

- Action Fraud: 0300 123 2040 or actionfraud.police.uk (creates official police record)

- Local Police: Call 101 to file formal report

- Your Bank: Provide all evidence and complaint numbers to their fraud department

- HMRC (if HMRC impersonation): Report via GOV.UK “report HMRC scam” page

Step 2: Financial Recovery

UK banks typically have two to three days to freeze transfers. The Confirmation of Payee system flags mismatched transfers and recovers approximately £50 million annually across the UK.

The Authorized Push Payment (APP) fraud scheme provides £1.2 billion in annual prevention and recovery, with many banks participating in voluntary reimbursement programs.

Step 3: The Tax Complication (Critical UK-Specific Issue)

This is where the UK situation becomes uniquely complex. If you recover funds from investment fraud:

Document absolutely everything related to the fraud and recovery.

Contact HMRC before recovered funds reach your account. Get ahead of potential tax complications.

Request formal guidance in writing on the tax treatment of recovered amounts. HMRC’s position on unauthorized payment classification can vary.

Consider working with a specialist tax adviser experienced in fraud recovery cases. Standard accountants may not understand this niche area.

If HMRC pursues tax liability you believe is unfair, consider contacting the Victims’ Commissioner for support and advocacy.

Step 4: Credit Monitoring

Monitor your credit reports through Experian, Equifax, or TransUnion. Access free annual reports via clearscore.com or by requesting a subject access request.

Place fraud alerts with all three credit agencies. Consider a credit lock through your chosen credit reference agency for maximum protection.

What the Law Says: Legal Framework in the US

Understanding the legal landscape helps you recognize that these scams are serious federal crimes, not just annoying phone calls.

Criminal Penalties for Scammers

When caught, digital arrest scammers face severe federal charges:

Wire Fraud (18 U.S.C. § 1343): Up to 20 years in federal prison and fines up to $250,000. This covers any fraud conducted via phone, internet, or electronic communication.

Bank Fraud (18 U.S.C. § 1344): Up to 30 years in federal prison when the scam involves fraudulent bank transactions or theft from financial institutions.

Impersonation of Federal Officers (18 U.S.C. § 912): Up to three years in prison for pretending to be a federal official like an IRS agent.

Identity Theft (18 U.S.C. § 1028): Up to 15 years in prison for using someone else’s personal information to commit fraud.

Government Response and Protections

The US government has ramped up response mechanisms in recent years:

FTC Impersonation Rule (effective 2024): Gives the Federal Trade Commission expanded authority to pursue impersonators directly and seek civil penalties and injunctions more efficiently under expanded enforcement authority.

FBI Recovery Asset Team: Achieves a 66% success rate in freezing fraudulent transfers when victims report within 72 hours. This team coordinates with banks and cryptocurrency exchanges to intercept money before scammers can withdraw it.

IRS Criminal Investigation Division: Files approximately 3,000 prosecution recommendations annually, though this represents only about 1% of reported cases due to the sheer volume.

Private Sector Protections

Banks and payment processors have implemented new safeguards:

Some banks may reimburse authorized push payment fraud under evolving consumer protection rules, but reimbursement is not guaranteed and varies by institution. This means if you were tricked into authorizing a transfer, your bank may reimburse you.

Payment processors increasingly use AI-driven fraud detection that blocks approximately 70% of attempted fraudulent transfers before completion.

Cryptocurrency exchanges cooperate with law enforcement through blockchain analysis companies like Chainalysis, enabling asset recovery in cases that previously seemed hopeless.

What the Law Says: Legal Framework in the UK

Criminal Penalties for Scammers

UK law treats these scams with equal seriousness:

Fraud Act 2006 Section 2 (fraud by false representation): Up to 10 years imprisonment for anyone who dishonestly makes false representations to gain money or property.

Communications Act 2003 Section 127 (improper use of communications): Up to 12 months imprisonment for sending messages that are grossly offensive or for the purpose of causing annoyance, inconvenience, or anxiety.

Proceeds of Crime Act 2002: Allows for asset forfeiture up to the full value of the fraud, meaning convicted scammers can lose all property purchased with stolen funds.

Government Response

The UK has established coordinated national infrastructure:

Action Fraud: The national fraud reporting center receives over 300,000 reports annually and coordinates investigations across police forces.

National Fraud Initiative: Prevented £1.2 billion in fraud during 2023 through data matching and early intervention.

Authorized Push Payment Scheme: Prevented £1.2 billion in 2023 and recovers 64 pence for every pound of attempted fraud. Most major UK banks participate in this voluntary reimbursement program.

Crown Prosecution Service: Now pursuing complex cybercrime cases with improved resources and specialized prosecutors trained in digital evidence.

The Unresolved UK Issue

The tax treatment of recovered fraud funds remains a contentious issue as of early 2026. The Victims’ Commissioner continues calling for legislative change to remove the 55-70% tax liability on recovered fraud amounts.

HMRC is not yet listed under the Victims Code, meaning fraud victims lack the formal victim protection status they’d have when dealing with police or prosecution services.

Proposed reforms would allow victims to recover funds tax-free, but parliamentary action remains pending. This leaves fraud victims in an impossible position: accepting potential financial ruin from tax bills or giving up on recovery efforts altogether.

Your Protection Checklist: United States

Here’s your actionable checklist. Print this out and check off each item:

☐ Program FBI IC3 number into phone: 1-855-292-3937

☐ Find and save your bank’s fraud number (on the back of your debit card)

☐ Verify and save IRS hotline: 1-800-829-1040

☐ Enable two-factor authentication on email accounts immediately

☐ Enable two-factor authentication on all banking apps

☐ Set up transaction alerts for $100 or more

☐ Establish rule: Never click links in unexpected emails or texts from financial institutions

☐ Create family protocol: If receiving suspicious calls, hang up, wait five minutes, call back using known official numbers

☐ For IRS issues: Always navigate to IRS.gov directly, never from email or call links

☐ Create verification call list with adult children: Any legal/financial crisis requires verification before action

☐ Check credit reports at annualcreditreport.com (free annually)

☐ Commit to reporting scams to FTC at reportfraud.ftc.gov within 48 hours of discovery

☐ For virtual kidnapping scenarios: Always call loved ones at their known number first

☐ For tech support: Never grant remote access to cold callers; call Apple/Microsoft directly using numbers from official websites

☐ Keep seven years of tax documents to prove legitimacy if targeted by IRS scams

Your Protection Checklist: United Kingdom

☐ Program Action Fraud number into phone: 0300 123 2040

☐ Find and save your bank’s fraud number (on the back of your bank card)

☐ Register for HMRC online account via gov.uk verify system

☐ Enable two-factor authentication on all online banking platforms

☐ Enable two-factor authentication on email accounts

☐ Set up transaction alerts for £500 or more

☐ Establish rule: Never click links in emails claiming to be from HMRC; always navigate to GOV.UK directly

☐ Save HMRC’s official number from GOV.UK: 0300 200 3300

☐ Create family protocol: Any legal/financial crisis requires independent verification first

☐ Check credit reports via clearscore.com or annual subject access request

☐ Commit to reporting scams to Action Fraud within 48 hours at actionfraud.police.uk or 0300 123 2040

☐ Request Confirmation of Payee service from your bank (flags mismatched transfers)

☐ If recovering fraud funds, contact HMRC tax department before deposits clear

☐ Save police non-emergency number: 101 (verify any police communication independently)

☐ Keep six years of tax records for HMRC verification purposes

☐ Locate specialist tax adviser experienced in fraud recovery cases before you need one

Moving Forward: Prevention Over Recovery

The truth about digital arrest scams is that prevention is exponentially more effective than recovery. Once money leaves your account, recovery rates—even with excellent law enforcement cooperation—hover around 30-66% at best. That means many victims lose a significant portion permanently.

The good news is that these scams are remarkably easy to defeat once you understand their tactics. Remember these core principles:

Legitimate government agencies never initiate urgent financial demands by phone. Full stop. If the IRS or HMRC has an issue with you, you’ll receive formal written correspondence with clear instructions and reasonable timeframes.

Time pressure is always a red flag. Real legal and financial issues unfold over weeks or months, not hours. Anyone claiming you must act “within two hours” or “before the end of the day” is trying to bypass your rational thinking.

Verification costs nothing but saves everything. Hanging up and calling back using an official number from a government website takes five minutes. That five-minute investment could save your life savings.

Share this information. The most vulnerable people in your life—elderly parents, grandparents, isolated family members—may not see articles like this. Have explicit conversations with them. Set up their phones with fraud detection. Create family protocols that require consultation before major financial decisions.

The scammers are sophisticated, but they’re not unstoppable. They rely on surprise, authority, and time pressure to bypass your defenses. Now you know their playbook.

Frequently Asked Questions

How do I know if the IRS really needs to contact me?

The IRS initiates all first contact through formal postal mail. You’ll receive an official letter with clear instructions, case numbers, and reasonable deadlines measured in weeks, not hours. The letter will direct you to specific pages on IRS.gov or provide a direct phone number to call them back—you’ll be calling them, not the other way around. If you’re genuinely unsure whether IRS correspondence is legitimate, call the official IRS number at 1-800-829-1040 and provide them with any reference numbers from the letter.

Can caller ID be trusted to verify who’s calling?

No. Scammers routinely spoof caller IDs to display official-sounding names like “IRS,” “HMRC,” or even your local police department’s number. This technology is inexpensive and widely available. Never trust caller ID as verification of a caller’s identity. Always hang up and call back using a number you independently obtain from an official website.

What if I already gave a scammer my personal information but didn’t send money?

Act quickly. Contact your bank immediately and place fraud alerts on all accounts. Change passwords for your online banking, email, and any other accounts where you used the same credentials. Place a fraud alert with all three credit bureaus (Equifax, Experian, TransUnion in the US; Experian, Equifax, TransUnion in the UK). Monitor your accounts daily for suspicious activity. Consider placing a credit freeze to prevent scammers from opening new accounts in your name. File reports with FBI IC3 (if in the US) or Action Fraud (if in the UK) even though you didn’t lose money—this helps authorities track the scammers.

Will my bank refund money I lost to a scam?

It depends on the type of scam and your bank’s policies. If scammers made unauthorized transactions without your knowledge, banks typically refund these quickly. However, if you authorized the transfer—even though you were tricked—recovery becomes more complex. US banks may reimburse under the proposed Consumer Fraud Prevention Act, but this isn’t universal yet. UK banks participating in the Authorized Push Payment scheme may reimburse you, recovering about 64 pence per pound on average. Your best chance is reporting immediately (within hours, not days) and providing comprehensive evidence that you were scammed. Time is absolutely critical—many banks can freeze transfers before they complete if you report fast enough.

How do virtual kidnappers get photos and information about my family?

Most information comes from social media. Scammers scrape Facebook, Instagram, and other platforms for family photos, relationship information, location data, and daily routines. They use this to create convincing scenarios: “I have your daughter Emma. She was at [specific coffee shop she posts about]. I’m watching her right now.” With the rise of AI tools, they can even create voice clones from short audio clips posted in videos. This is why privacy settings matter. Review your social media privacy settings today and limit who can see personal information, especially details about children or grandchildren.

What should I tell my elderly parents about these scams?

Have a direct, non-condescending conversation. Explain that government agencies never call demanding immediate payment. Create the physical “Verification Call List” with them and hang it somewhere visible. Most importantly, establish a family protocol where they agree to call you before making any financial decision in response to unexpected contact. Frame it not as “you’re vulnerable” but as “these scammers are sophisticated and targeting everyone, so let’s create a backup system.” Consider setting up call screening services on their phones and enabling transaction alerts on their bank accounts.

Is it safe to answer unknown numbers?

You can answer, but be extremely cautious about engaging. Don’t confirm personal information, don’t press numbers they suggest, and don’t follow instructions to call back on a different number. If something feels off, hang up immediately. Better yet, let unknown numbers go to voicemail. Legitimate callers will leave messages. Many smartphones now have built-in spam detection—enable these features. Services like RoboKiller or Nomorobo can filter most scam calls before they reach you.

What happens if HMRC really does have an issue with my taxes in the UK?

HMRC communicates through formal letters sent to your registered address or through your official HMRC online account at gov.uk. You’ll receive clear documentation with case reference numbers, specific details about the issue, and reasonable timeframes for response (typically 30 days or more). You’ll have the right to appeal decisions and request additional time if needed. HMRC provides a dedicated helpline (0300 200 3300) that you call at your convenience—they don’t call you out of the blue demanding immediate payment. If you receive any communication claiming to be from HMRC, verify it by logging into your online account directly through gov.uk or calling the official number yourself.

Can I get in trouble for hanging up on a legitimate government call?

No. Legitimate government agencies expect you to verify their identity independently and actually encourage this practice. They understand that scams are prevalent and won’t penalize you for being cautious. If it’s genuinely a government agency, they’ll have sent written correspondence first, and you can call them back using official numbers at your convenience. Never feel pressured to stay on a call that makes you uncomfortable.

What if I already paid a scammer? Is my money gone forever?

Not necessarily, but time is critical. Contact your bank within one hour if possible. Many fraudulent transfers can be frozen before completion if reported quickly. File reports with FBI IC3 (US) or Action Fraud (UK) immediately. The FBI’s Recovery Asset Team has a 66% success rate when contacted within 72 hours. For cryptocurrency payments, contact the exchange immediately—some cooperate with law enforcement for freezing and recovery. For gift cards, contact the retailer immediately with card numbers and receipts. Some retailers can freeze unused balances. Your recovery odds decrease dramatically after 24-48 hours, so act immediately.

Are younger people less vulnerable to these scams?

Not necessarily. While older adults lose more money on average per scam, younger people report high numbers of fraud attempts. Young adults fall victim to different variants—cryptocurrency investment scams, romance scams, and tech-savvy schemes. The belief that “I’m too smart to fall for this” actually increases vulnerability because it reduces vigilance. Everyone is vulnerable under the right psychological pressure. The key is recognizing that intelligence doesn’t protect you from manipulation—knowledge and protocols do.

How can I tell if an email from HMRC or IRS is real?

Legitimate government tax agencies rarely send unexpected emails about tax issues. In the US, the IRS sends official letters, not emails, for virtually all tax matters. They might send emails if you’re already enrolled in specific electronic communication programs, but these won’t contain links to external sites. In the UK, HMRC primarily communicates through your registered online account at gov.uk or by letter. Real HMRC emails come from “@hmrc.gov.uk” addresses (though this can be spoofed), contain your unique taxpayer reference, and never include links to external payment sites. When in doubt, don’t click any links—navigate directly to IRS.gov or gov.uk by typing the address yourself, log into your account, and check for messages there.

Digital arrest scams represent a sophisticated evolution of age-old con games, leveraging modern technology and psychological manipulation to devastating effect. The $16.6 billion lost to cyber fraud in the United States and over £1.26 billion in the United Kingdom demonstrate that this isn’t a minor inconvenience—it’s a genuine threat to financial security.

But you’re now armed with the knowledge to protect yourself. You understand the red flags, you know the verification procedures, and you have specific action steps for prevention and recovery.

Share this information with the people you care about. Have those awkward but necessary conversations with elderly relatives. Set up protection mechanisms on your devices and accounts today, not after you’ve been targeted.

The scammers depend on secrecy, shame, and isolation. By spreading awareness and creating family safety protocols, you’re not just protecting yourself—you’re disrupting their entire business model.

Stay skeptical. Stay informed. Stay safe.

Resources:

- US FBI IC3: https://www.ic3.gov or call 1-855-292-3937

- US Federal Trade Commission: https://reportfraud.ftc.gov or call 1-877-438-4338

- US IRS Official: https://www.irs.gov or call 1-800-829-1040

- UK Action Fraud: https://www.actionfraud.police.uk or call 0300 123 2040

- UK HMRC: https://www.gov.uk/government/organisations/hm-revenue-customs or call 0300 200 3300

- Voice Cloning Scam Protection: https://simplyseniortech.com/grandparent-voice-cloning-scam-protection-guide/

This article was compiled from official government sources, law enforcement data, and fraud prevention organizations. While every effort has been made to ensure accuracy, tax laws and fraud prevention guidelines may change. Always consult official government websites for the most current information.Share

Disclaimer: This article is for informational and educational purposes only. It does not constitute legal, financial, or tax advice. While every effort has been made to ensure the accuracy of agency contact details and legal protocols as of January 2026, scammers frequently update their tactics, and government procedures may change. If you are a victim of fraud, always contact your local law enforcement agency, bank, or a qualified legal professional immediately. The author and publisher assume no liability for any financial loss or damages resulting from the use of this information.